Since 2008, EM periods of outperformance have tended to be short-lived, but since 2016, there has been an extended period of outperformance and we expect this to continue.

So far this year, EM are up 12% versus around 0% for global markets (in EUR)*. Some of the strongest markets worth mentioning are Turkey, China and Korea while Russia, Brazil and South Africa are among the major underperformers as they have had their own issues to deal with.

The case for investing in EM

Over the summer, we have seen release of various economic data points showing a continuation of strong trends globally. EM is the driver of global growth, and the growth gap to developed markets (DM) will continue to increase in 2017/18 according to IMF's latest predictions. EM's track record is outstanding: in every single quarter for more than 10 years, EM has made a contribution to overall global growth in excess of 50%. There is little correlation between a single country's GDP growth and equity returns in the short term, but in the long run and on an aggregate level, the story is slightly different.

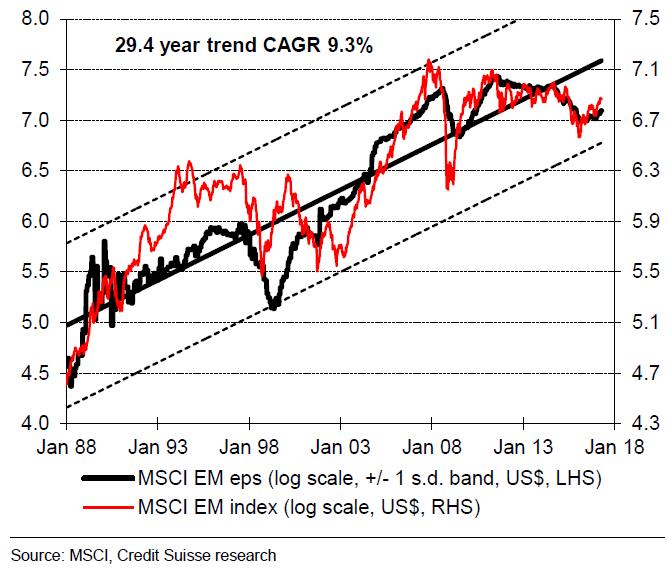

Extending the comparison from economic growth to corporate earnings, since 1980, yearly EPS growth of almost 9.5% for EM is similarly much higher than around 5.5% in DM over the same period (USD) according to research by Credit Suisse.

Superior demographics and urbanisation trend

EM growth outperformance is likely to be supported by two major and long-term underlying trends. The first is superior demographics. According to the UN, 97% of population growth between now and 2050 is likely to occur in EM. The working age proportion will be higher than in DM going forward, allowing for a significantly less burdensome dependency ratio for the former. Based on the UN's statistics, over the same time period, there will be an additional 2.3 billion potential consumers and workers in EM versus less than 100 million in developed nations. Another supportive long-term trend is urbanisation, which still hasn't played out entirely with around 50% urbanisation in EM versus above 80% in DM.

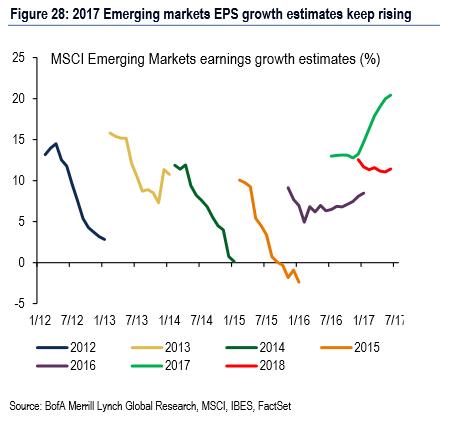

To take it back to the corporate level, part of the reason for EM's weak equity performance over recent years has been due to earnings downgrades over the past 6 years. However, in 2017, the trend has reversed and there have been positive earnings revisions that continued with the most recent earnings season. In 2017, EPS estimates have increased from around 15% growth to more than 20% expected growth for 2017.

The good news is that the earnings revisions have been driven by margins going up again from almost record low levels. In turn, the margin increase seems to be coming from productivity growth, which is also positive for EM.

Better economic shape

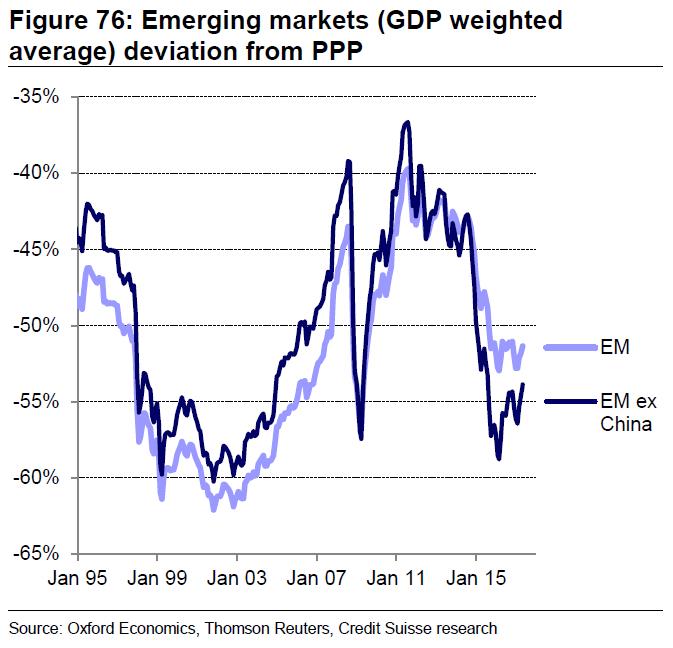

Another reason why we are positive to EM is that on an aggregate level, EM fundamentals have improved markedly both versus history but also compared to DM. In addition, collectively speaking, EM currencies look cheap based on purchasing power parity. Thus, as a group, EM should retain scope for currency revaluation as their per capita economic output converges with DM.

When it comes to political risk, this has been increasing globally over the past few years, but relative to DM it has, if anything, been stable or improved in EM. Taking into account the current global situation, it is fair to ask whether the risk in the short term is not actually higher in DM. We could argue that EM countries are at least used to dealing with political risk and it might also be better reflected in valuations already.

Good environment for global equities

To conclude, the combination of strong and increasing global growth and low inflation (which has come down markedly over the past few months in EM) tends to create a good environment for global equities. Return on equity in EM has recovered and is above DM levels and EM still trades at a more than 25% P/BV discount to DM. On an absolute level, valuations seem reasonable at slightly below the historical average on P/B multiples but slightly above on P/E. On a relative basis compared to DM, the picture looks as strong as at the beginning of the year on the back of strong fundamentals in EM.

*as of 27 August 2017