The content on this page is marketing communication

Performance Update Q3 2018

SKAGEN Performance Update – A macro-driven third quarter

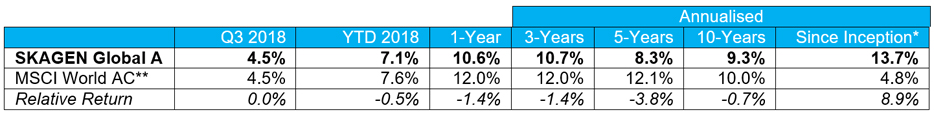

SKAGEN Global

Developed market strength drives solid absolute performance as fund makes new US investments. SKAGEN Global A increased 4.5% in the quarter, in line with the MSCI All Country World Index which also added 4.5%.

Figures as at 30 September 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 07/08/1997

** Before 01/01/2010 benchmark was MSCI World Index

- US technology giant Microsoft was the largest contributor with the fund’s largest holding, which we believe remains at a steep discount to intrinsic value, continuing to benefit from growth in its cloud business. Auto technology company Veoneer was the next best performer, boosted by its spin-off from Autoliv which unlocked the hidden value we envisaged in our investment case.

- Autoliv was the biggest detractor as it lowered guidance due to market weakness for its auto safety products. Capgemini was the next largest drag on performance with the French technology company signalling a slowdown for the second half of the year; we see this guidance as conservative and expect the share price to recover relatively quickly.

- Five new US holdings entered the fund with the September additions of Home Depot, a strong multi-channel retailer capable of growing market share, and Old Dominion Freight Line, a growing logistics provider with strong operational performance and customer service. These followed new investments in JP Morgan, Accenture and Nasdaq earlier in the quarter.

- Seven companies left the portfolio with the sale of Citigroup and Autloliv / Veoneer (where our investment theses were realised) as well as Henkel and Baidu (both to fund alternative opportunities) in September, following the earlier disposals of Shangri-La, Golar LNG and CK Asset Holding.

Quarterly Report: Read the SKAGEN Global Q3 2018 Report here

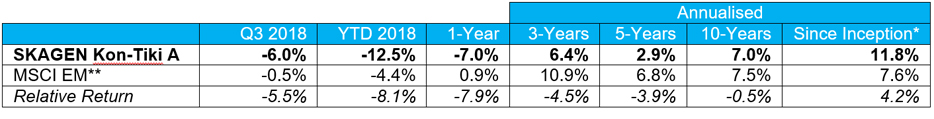

SKAGEN Kon-Tiki

Relative weakness as macro headwinds continue to weigh on EM performance. SKAGEN Kon-Tiki A fell 6.0% during the quarter, underperforming the MSCI Emerging Markets Index which dropped 0.5%.

Figures as at 30 September 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 05/04/2002

** MSCI EM Index (net total return) did not exist at the inception of the fund and consequently the benchmark index prior to 1/1/2004 was the MSCI World AC Index. This is not reflected in the table above which shows the MSCI EM Index since the fund’s inception

- Ericsson was the best performer as the Swedish telecom company delivered higher margins driven by cost reductions, demonstrating that the company’s turnaround is on track ahead of the 5G investment cycle. Atlantic Sapphire was the next largest contributor with the Norwegian salmon farmer delivering positive results following a successful capital raise in the second quarter.

- Among a weak Turkish equity market, conglomerate Sabanci Holding was the fund’s largest detractor, impacted by rising domestic inflation and currency weakness, particularly in its Akbank subsidiary. Naspers was the next biggest drag on performance with the South Africa conglomerate impacted by weakness in its Tencent holding following heightened Chinese regulatory pressure.

- Four new companies joined the fund; Ivanhoe Mines (a Canadian listed miner with some of the most significant recent copper discoveries), Mexchem (a Mexican petrochemical company expected to benefit from rising commodity prices), Ping An (a Chinese financial services group well-positioned for growth in insurance protection products and with a strong fin-tech offering) and Euronav (a Belgium shipping company which has made attractive investments but retains a solid balance sheet).

- We exited from Sabanci Holding given the changing risk / reward proposition described above.

- The portfolio valuation remains highly attractive, trading on a weighted 2019 P/E ratio of less than 9x and trailing P/B of 1x, a discount of 20% and 35%, respectively, to the MSCI EM index.

Quarterly Report: Read the SKAGEN Kon-Tiki Q3 2018 Report here

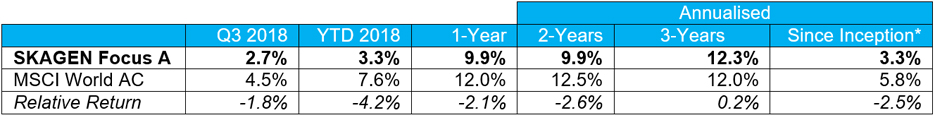

SKAGEN Focus

Solid absolute gains driven by strong Japanese performance as several new holdings join the fund. SKAGEN Focus A added 2.7% over the quarter, lagging the MSCI All Country World Index which climbed 4.5%.

Figures as at 30 September 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 26/05/2015

- Softbank was the top performer with the Japanese IT conglomerate continuing to close the share price discount to its net asset value and whose impending flotation of Softbank Mobile could be a further re-rating catalyst. Compatriot SBI Holding was the next best performer as the market awaits the listing of SBI Insurance and gradually starts to ascribe a more realistic value to the financial services conglomerate.

- Gold Field was the largest detractor following the South African miner’s decision to restructure its sole domestic asset, South Deep. Telecom Italia was the next worst performer, weighed down by the country’s continued political uncertainty and disagreement between the company’s two largest shareholders.

- Four new companies entered the portfolio with undervalued US chicken producer Pilgrim’s Pride joining in September, following the addition of OMV, Metro and KOC Holdings earlier in the quarter.

Quarterly Report: Read the SKAGEN Focus Q3 2018 Report here

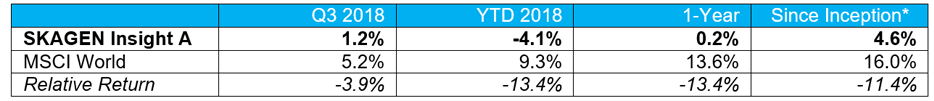

SKAGEN Insight

Risk-off sentiment drives relative weakness despite positive corporate transformation within the portfolio. SKAGEN Insight A increased 1.2% during the quarter, underperforming the MSCI World Index which was up 5.2%.

Figures as at 30 September 2018 in EUR and net of fees

* Inception date: 21/08/2017

- Armstrong Flooring was the top performer after delivering better than expected results which appeared to mark a turning point for the US company as it seeks to restore growth and boost margins. Japanese disaster prevention equipment supplier Teikoku Sen-I was the next best performer, also boosted by unexpectedly strong results and the potential for further value creation as the upcoming proxy season approaches.

- Diebold Nixdorf was the largest detractor as the US ATM provider’s shares came under pressure from short sellers, although speculation it would run out of cash proved misplaced after debt finance was agreed. General Electric was the next weakest performer, weighed down by a stream of negative news and its complex conglomerate structure.

- No companies entered or exited the portfolio during the quarter.

- The portfolio is attractively valued, currently trading on a P/E (t+3) of 8.7x normalised earnings, representing a 36% discount to the broader market.

Quarterly Report: Read the SKAGEN Insight Q3 2018 Report here

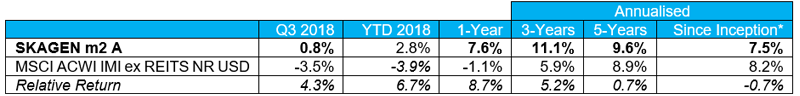

SKAGEN m2

Strong performance from Swedish holdings drives solid absolute and relative gains. SKAGEN m2 A added 0.8% during the quarter, outperforming its benchmark index which fell 3.5%.

Figures as at 30 September 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 31/10/2012

- Swedish companies provided the fund’s best performers as the domestic real estate sector rebounded during the quarter on strong growth in rental income and property values. D Carnegie, which has changed its name to Hembla, was the largest contributor, boosted by revaluation gains and the acquisition of competitor, Victoria Park. Compatriot Catena was the next best performer as it continued to perform well on strong underlying fundamentals, driven largely by e-commerce growth.

- Shangri-La was the worst contributor with the Hong Kong-based hotel operator hurt by a sluggish domestic market due to concerns over Chinese trade tensions and credit tightening. Spanish Melia Hotels was the next worst performer as a result of weak domestic tourism.

- The fund’s outlook is positive with the potential for rental increases and further M&A activity in the listed property market during the year.

- The portfolio is attractively valued with holding companies generally trading in line with or lower than their historic averages.

Quarterly Report: Read the SKAGEN m2 Q3 2018 Report here

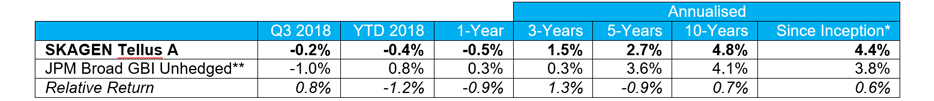

SKAGEN Tellus

EM uncertainty impacts absolute return as Trump tariffs and Italy concerns weigh on global bond markets. SKAGEN Tellus A fell 0.2% in the quarter, outperforming the JPM Broad GBI Unhedged index which dropped 1.0%.

Figures as at 30 September 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date 26/05/201529/09/2006

** Before 01/01/2013 benchmark was Barclay's Capital Global Treasury Index 3-5 years

- Our Mexican bond holding was the best performer, driven by sharp appreciation of the peso on expectations of successful NAFTA renegotiations. The fund’s Norwegian investment also performed strongly, boosted by a rising oil price and economic growth.

- The Dominican Republic provided our weakest investment as monetary policy tightening and market volatility contributed to drive long-term interest rates higher. Uruguay was the next worst performer as negative sentiment in neighbouring Argentina spilled over and caused currency depreciation of the Uruguayan peso.

- The fund increased the size of its investments in the Czech Republic and Norway during the quarter as both investments have short duration and are expected to benefit from currency appreciation versus the euro through central bank tightening ahead of the ECB.

- We exited from New Zealand and reduced our holding in Spain.

Quarterly Report: Read the SKAGEN Tellus Q3 2018 Report here

All contribution figures are based on NOK returns at the fund level.

Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on market developments, the fund manager’s skill, the fund’s risk profile and subscription and management fees. The return may become negative as a result of negative price developments.

This message is only intended for the recipient and may contain confidential or other private information.