Following a stellar 2021, equity investors have had a reality check at the start of 2022. Global stock markets fell 4% in January but before hitting the panic button, it is useful to consider this decline in the context of our recommended holding period.

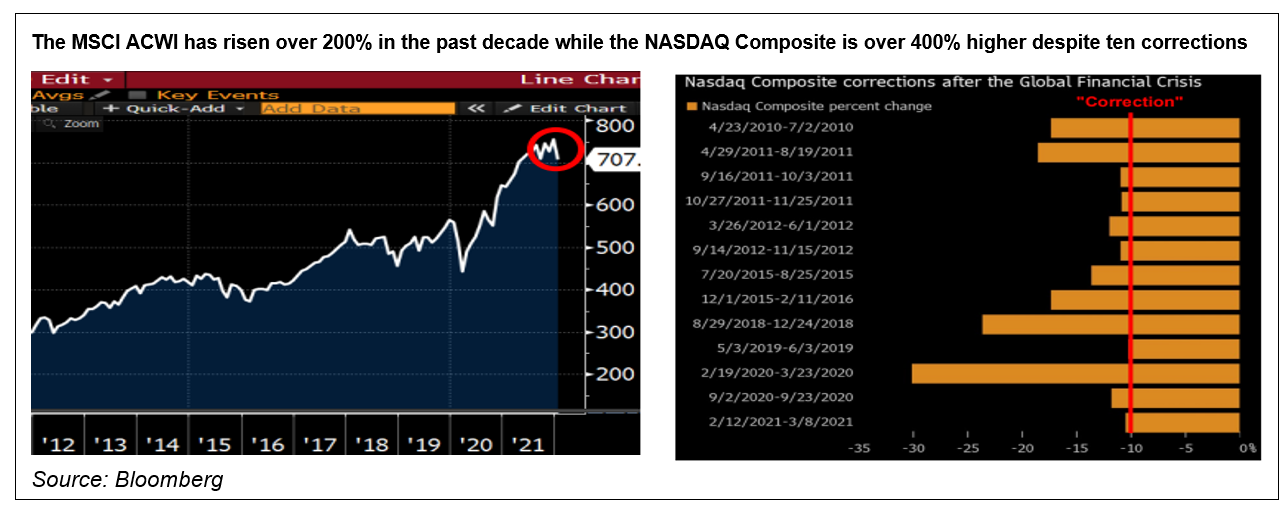

Including January's loss, global equities have risen 70% in five years and 224% over 10 years, illustrating the benefit of holding your nerve in times of market weakness. NASDAQ investors lost 10% last month as tech companies bore the brunt of the sell-off but have still gained 150% over five years and are almost five times better off than they were a decade ago – a period which has now seen the Nasdaq index fall over 10% on ten occasions[1].

Over the horizon needed to generate decent investment returns, market wobbles are perfectly normal as Knut Gezelius, Lead Portfolio Manager of SKAGEN Global, explains: "Investors should think of short-term volatility as the price to pay mentally for staying in the game and earning long-term excess returns. Given that the reporting season has only just started, January's reversal looks to have been driven by anxiety rather than any evidence of weakness in company performance. If anything, most of the reports delivered so far from our portfolio holdings have shown fundamental strength."

Inflation and an escalation of tensions between Russia and the Ukraine are the cause of investors' January blues that pushed the VIX index – or fear gauge – above 30 for the first time in over twelve months; a threshold considered a signal of market tension. Such turbulence can also present buying opportunities, however, as Gezelius explains: "Stocks have historically performed strongly immediately following a correction. Since 1970, the S&P 500 has risen 27% on average in the 12 months following a drop of between 10% and 20%, suggesting that now could be a good time to add exposure to companies around the world."

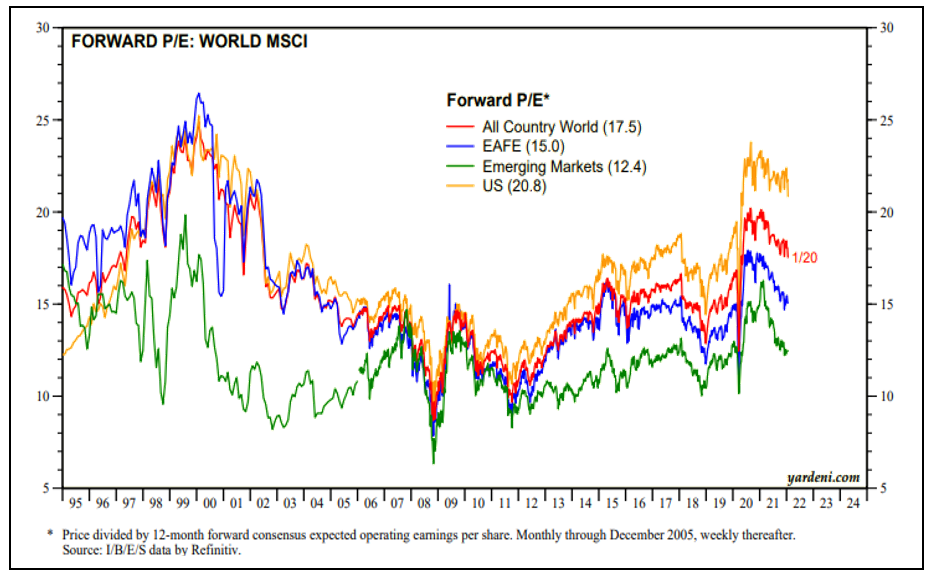

Today's environment provides fertile ground for stock pickers, particularly those with the freedom to invest globally and with long-term investment horizons like SKAGEN. The dispersion in valuations remains close to historic highs (see chart below) with many markets, particularly in developing regions trading well below average multiples. There has also been huge dispersion in sector returns so far in 2022 with cyclicals performing relatively strongly, which is also supportive for active managers to generate excess returns.

Value momentum

The relative strength of sectors such as energy and financials has driven a strong rotation to value which outperformed growth by seven percentage points[2] in January as investors moved out of big tech companies and into stocks which are more sensitive to economic growth and higher interest rates.

This is good news for value investors like SKAGEN. Our bottom-up approach means we only select companies we believe offer superior risk-adjusted returns for our portfolios. Our long-term approach means that we aim to outperform the market across a range of macro and market scenarios, for example by investing in companies whose competitive strength means they can withstand rising input prices in periods of inflation like we are currently experiencing.

An active approach also enables our funds to avoid stock market bubbles where high valuations mean downside risks outweigh upside rewards. This is a perennial danger for index investors, particularly those with exposure to markets trading at excessively high multiples compared to their fundamentals.

With Russia and North Korea flexing their muscles so far in 2022 geopolitics are another risk for investors that stock picking (or avoiding) can help navigate. While our approach is bottom-up, political threats form a key part of the risk framework used by our portfolio managers. For example, our funds currently have no exposure to stocks listed in Turkey, which was one of the worst performing stock markets in 2021 with losses of 26%. SKAGEN Global has not had any direct investments in Turkey since 2016.

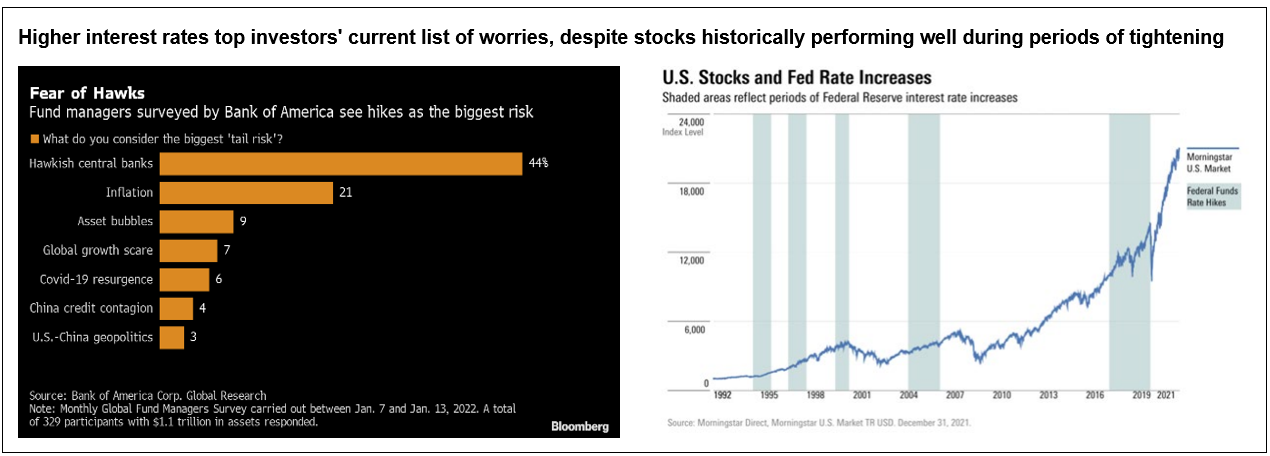

Bank of America's January fund manager survey cited rising interest rate rises as their biggest concern, with some Wall Street analysts forecasting up to seven hikes this year to combat inflation. This is despite stocks performing solidly during previous tightening cycles, as Gezelius explains: "We don't think there's any cause for alarm just because the Fed is likely to rise interest rates. Conversely, it can be healthy for equities if it helps to combat the punitive impact of inflation on consumers and businesses."

Higher interest rates should also boost the earnings of financial services companies, such as banks and insurers – another potential advantage for active investors like SKAGEN who can take and size positions in companies regardless of their position in a particular index.

With the earnings season to come and several important elections this year it is likely that volatility will remain high in the short-term. However strong the temptation is to stay on the sidelines or to try and boost returns by timing the market, it is likely to be far less profitable – and much more difficult – than a long-term buy and hold strategy.

Footnotes:

[1] Global equities performance measured by MSCI All Country World Index in EUR as at 31/01/2022

[2] Source: MSCI. MSCI ACWI Value (-1.0%) vs. MSCI Growth (-8.3%) in EUR as at 31/01/2022