The content on this page is marketing communication

About us

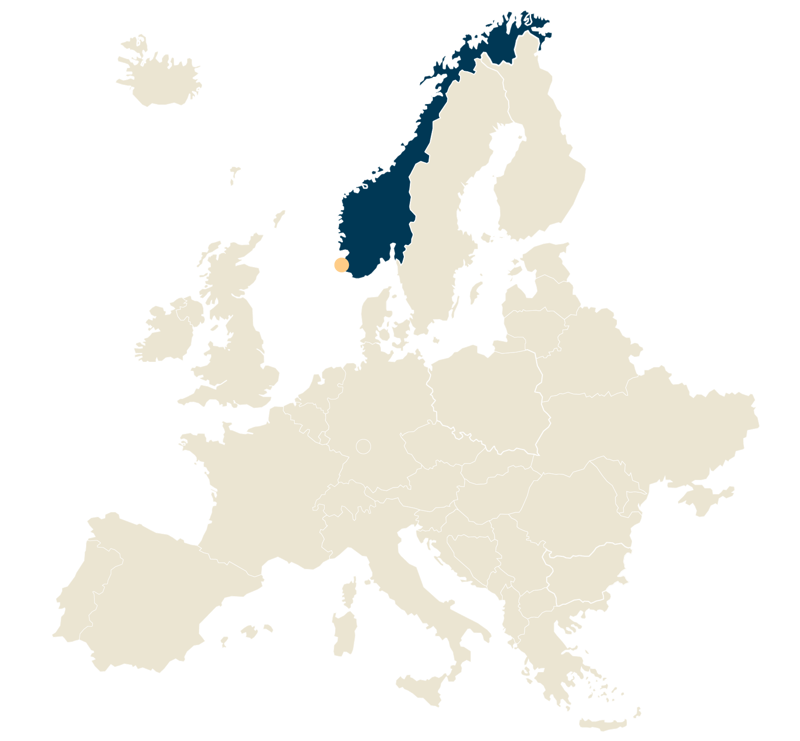

Since the launch of the first SKAGEN fund in 1993, the SKAGEN funds have established a long track-record of delivering alpha for international investors through a range of equity strategies guided by an active value-oriented investment philosophy.

Contrarian approach, independent thinking

The highly active, value-based SKAGEN fund range has generated strong returns for unitholders for over 30 years.

The portfolio managers are dedicated stock pickers who conduct their own in-depth company research and analysis. They take a long-term investment approach and are willing to invest in overlooked or out-of-favour companies if it is in the best interests of the funds' unitholders.

The funds' objective is to provide the best possible risk-adjusted returns.

1993

Around 448 unit holders

Approx. EUR 2.4 million under management

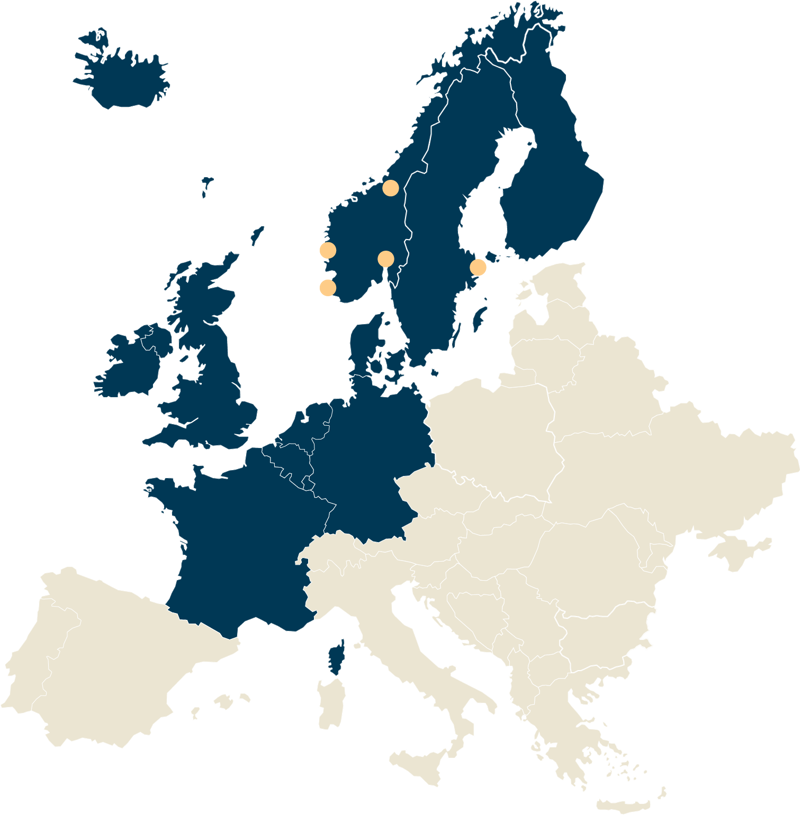

2024

Around 90 000 unit holders

Approx. EUR 6.6 billion under management

Simple investment philosophy

Our investment philosophy is simple: to find investments that are mispriced by the market, but whose value is likely to be recognised in future, and which offer great potential for the risk taken.

SKAGEN has a single house philosophy that we have applied consistently since start.

We offer:

- Value focus

- Global mandates

- Active management

- Long-term focus