Furthermore, there is an interesting market phenomenon that small-caps tend to outperform large-caps over the long-term. Often, smaller companies have more focused business operations, higher returns on capital and are better able to participate in structural market changes such as consolidation.

1. Return of the size premium

Smaller companies normally deliver better long-term returns than larger ones. The 'size premium' was identified in 1993 by Nobel prize-winning researchers Eugene Fama and Ken French who found Small Minus Big (SMB) to be a key factor (alongside value) in explaining stock market outperformance[1]. Their study found that the smallest 10% of US stocks beat the largest 10% by an annualised 2.4%.

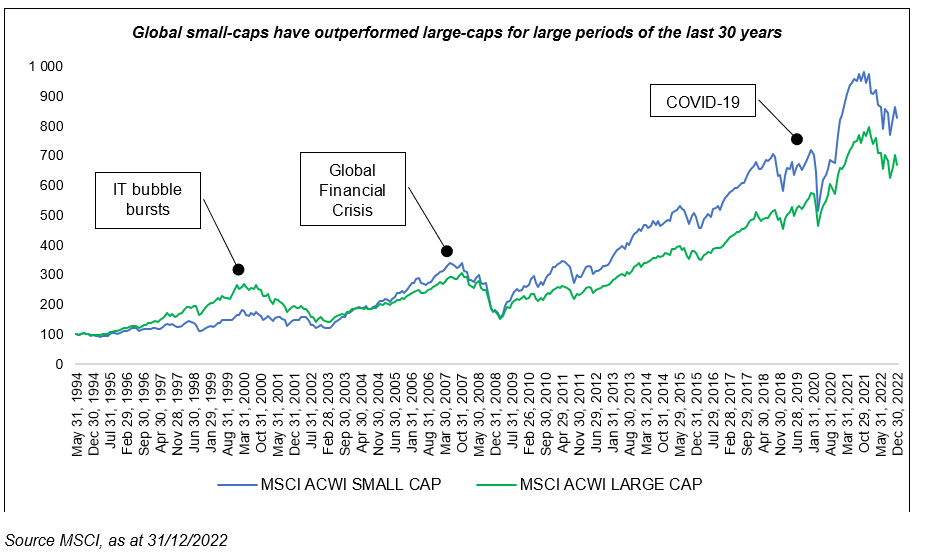

The three decades since show a similar story across global markets. The long-term trend of small-cap outperformance reversed during the 1990s but returned following the bursting of the IT bubble at the turn of the century. During the 2008 global financial crisis, small-cap stocks suffered more than large-cap ones but then rebounded more quickly and have outperformed since.

2. Valuations highly attractive

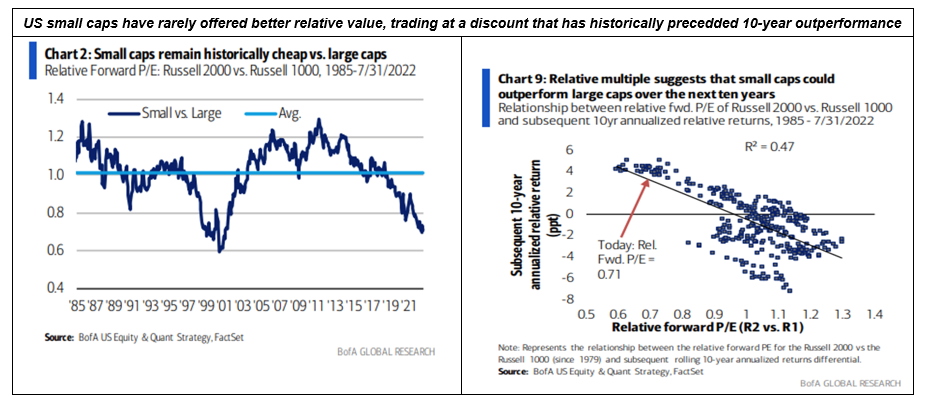

Global small-caps have continued to outperform so far in 2023 but remain valued at bargain prices. In the US, for example, the Russell 2000 Index of smaller companies currently trades on a forward P/E of 13.5x, around 13% below its long-term average[2].

Prices look even cheaper relative to large-caps. Smaller companies have traded at a premium to larger ones for long periods but are currently 30% cheaper in the US – a discount that has only previously been as wide during the IT bubble[3]. The current level has historically been followed by annualised returns of 12% over the next decade, 4% greater than the Russell 1000 index of larger companies.

For SKAGEN Focus, where we need to see at least 50% upside over a 2–3-year investment horizon, these discounts mean that our current investment universe is large. For global value investors like us, valuations outside of the US are even more compelling and the opportunity set continues to grow. We have recently picked up small-cap bargains in Japan, Korea and Europe where stocks are trading well below 30-year averages and offer significant potential gains.

An added benefit of such attractive valuations is the possibility of smaller companies being acquired by competitors, larger consolidators or private equity at a generous share price premium. Three of our holdings (Stagecoach, First Horizon and Albertsons) were taken over last year, following six portfolio acquisitions in 2021, all of which created significant value for unitholders.

3. Increasingly below-the-radar

The rise of passive investing in recent years has helped push large-cap valuations higher but also increased inefficiencies at the smaller end of the market which contrarian stock pickers can use to their advantage. Most indices are market-cap weighted which means the funds tracking them are naturally tilted towards the largest stocks; the average company size in the global index, for example, is over $20bn[4].

Larger active funds also often avoid smaller companies – as do 'closet indexers' who claim to be active but hug the benchmark – meaning they are covered by increasing fewer analysts. A lack of information and liquidity creates an inefficient market that is ripe for investors prepared to do their own research to exploit, particularly given the many small-caps currently trading at wide discounts to intrinsic value.

Further opportunities can come from special situations, for example companies spinning off business units or assets to shareholders whose lack of knowledge means they sell the often-undervalued shares. In 2022, SKAGEN Focus was boosted by Continental spinning off Vitesco, Iveco coming off from CNHI Industrial, as well as Accelleron, which was spun off from ABB.

The flip side is that investors in passive funds (particularly those with a US bias) have significant exposure to big technology stocks, which still represent a large part of the index despite last year's sell-off. This potentially represents a systematic portfolio risk given the headwinds these growth companies face in an environment of higher interest rates and economic pressures.

4. Cyclical tailwinds may be building

The market has already anticipated that recession is around the corner. Indeed, a few geographic areas are already experiencing economic contraction. Smaller companies' revenues may be more cyclical and recession fears have therefore disproportionately hit their valuations. This has been compounded by the perception that large-caps generally have greater pricing power to navigate rising inflation.

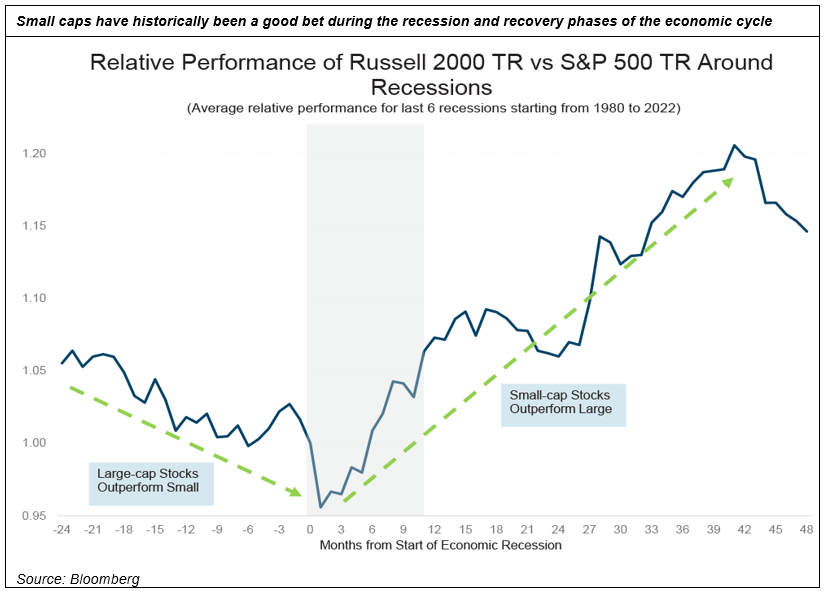

With inflation peaking and hopes rising for a softer economic landing, however, smaller companies have flourished. They also tend to do better than larger companies on entering recession as they can cut costs and inventories more easily, and then rebuild more quickly as the economy recovers. This is reflected in small-caps outperforming large-caps in each of the last six US recessions since 1980, delivering superior returns into and throughout the recovery phase of the economic cycle.

The market sell-off in 2022 has also seen many large and mid-cap companies fall into the small-cap rankings, triggering index expulsion and subsequent forced selling by passive investors. These 'fallen angels' are generally more value-orientated than those usually found in small-cap indices. Similar downgrades have historically given a further boost to small-cap returns as value companies in sectors like industrials, materials and financial services tend to outperform during economic recovery.

5. Driving the green transition

In tandem with superior financial returns, small-caps can offer environmental benefits despite being frequently overlooked in the rise of sustainable investing. Largely guided by disclosure and policies, ESG ratings are biased towards larger companies with greater resources to provide sustainability data and reporting. This subsequently tilts ESG funds towards large-caps, creating further market inefficiencies that can be exploited given these products' growing influence on the investment landscape.

Although ignored by rating agencies, small-caps are often making huge strides in ESG that can trigger a share price re-rating once their 'green premium' is understood by the market. Equally important is the role that small-caps are playing in the green transition. Italian company Cementir, for example, has developed low-carbon technology that produces 'green' cement with up to a 30% smaller carbon footprint that ordinary cement. Another holding Befesa, which specialises in the collection and recycling of steel dust and aluminium residues, has been a part of the circular economy for over three decades. Similarly, Cascades is a Canadian company that produces packaging and tissue products composed mainly of recycled fibres.

Strategy paying off

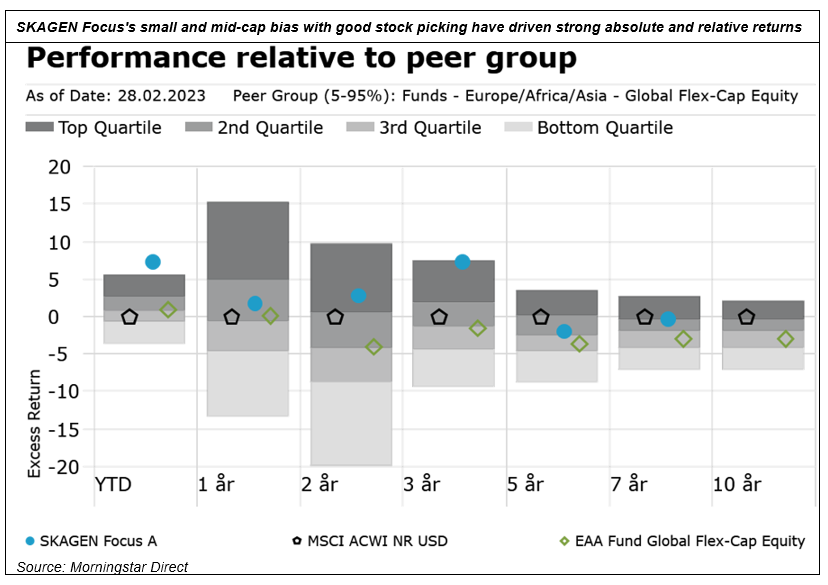

SKAGEN Focus currently has around three quarters of its portfolio invested in contrarian small and mid-cap companies which have helped to boost returns. Year-to-date the fund is among the top 3% performers of its global peer group according to Morningstar analysis which also places Focus among the best 6% of performers over a 3-year period.

The uncertain economic outlook means that the operating environment for companies of all sizes is likely to be challenging. However, this will result in a greater dispersion between the winners and losers in the global equity market, particularly among small-caps where active value managers can thrive. With valuations also at historically attractively levels, our price-driven, contrarian and long-term approach means that SKAGEN Focus is well-placed to continue delivering superior returns for clients by capturing the opportunities in a normalised investment environment.

[1] Fama, E., French, K.,1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics

[2] Source: Russell 2000 Index factsheet, as at 28/02/2023

[3] Source: Russell 1000 Index factsheet as at 28/02/2023

4] MSCI All Country World Index as at 31/01/2023