1. Real estate provides an effective hedge against inflation

With inflation currently running at 7.5%[1] in Europe and predicted by some commentators to go even higher, investors are understandably concerned about rising prices eating into their savings and investment returns. Real estate offers inflation protection in a number of ways – a key factor driving the sector's strong recent returns and expectations for continued outperformance.

First, rents are usually inflation-linked which means landlords' revenues are automatically shielded from rising prices (segments such as self-storage and hospitality should even benefit as they can increase rates quickly, demand is sticky and costs relatively fixed). Dividends from real estate investment trusts (REITs) have grown at a faster rate than inflation in all but two years since 2000 – during the financial crisis and COVID – and usually by a significant margin[2].

Second, inflation boosts asset prices and real estate transaction values as rising land and construction costs makes building new properties relatively unattractive (see Mergers & Acquisitions below).

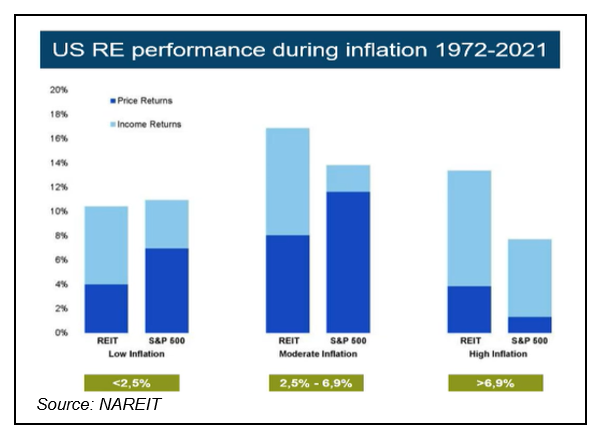

These positive income and price effects mean that real estate has performed strongly during previous periods of high and moderate inflation over the past 50 years, both in absolute terms and relative to equities (see chart). With bonds and bank savings devalued by rising prices, it is easy to see why real estate is a popular asset class during inflationary periods.

2. Diversification benefits

With people's savings often largely invested in their own homes and cabins it is understandable that some may be reluctant to seek more real estate exposure in their investment portfolios. However, property markets are mainly driven by local factors so adding exposure to different countries and sectors away from home is a good way to reduce the risk of our own properties falling in value. For example, the Nordic Real Estate Index has lost 13.3% so far this year whereas the Middle East and Africa has gained 11.0%[3].

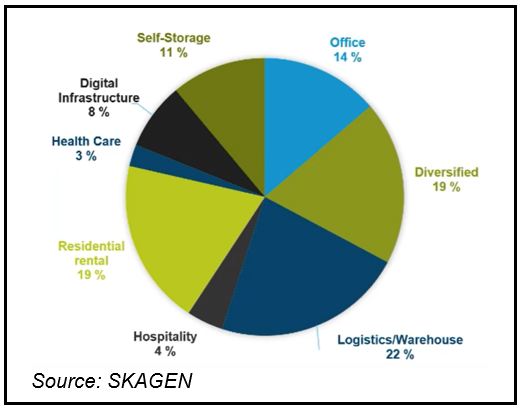

Further diversification benefits come from the wide variety of segments within listed real estate which have different return drivers. Some, such as infrastructure and data centres, are relatively new and provide returns uncorrelated with residential property.

SKAGEN m2 currently has a portfolio of 33 companies from 15 countries and 8 different sub-sectors (see chart). The fund is also divided between small (40%), mid (42%) and large (18%) cap companies, which provides an additional diversification benefit for investors[4].

3. Ride the economic recovery

Real estate offers a tangible way for investors to gain exposure to rising economic activity. Listed companies additionally provide access to property segments that would otherwise be closed to private investors, such as hotels and offices. These are the two best performing sub-sectors this year, boosted by the return of travel and trend away from home working[5]. Offices have experienced a notable shift in sentiment as many companies pivot back to pre-pandemic ways of working, demonstrated by the demand for premises outstripping supply in the US for the first time since 2018[6].

Despite global growth forecast to be a healthy 4.4%[7] this year, clouds remain on the economic horizon. The US yield curve has inverted, flagging the risk of recession and the war in Ukraine continues to cast a shadow beyond the terrible human suffering. Given this uncertainty, SKAGEN m2's portfolio is positioned roughly 60:40 between more defensive segments such as data centres, logistics, self-storage, residential, rental and health care, and those geared towards economic recovery like office, retail and hospitality.

4. Mergers & Acquisitions

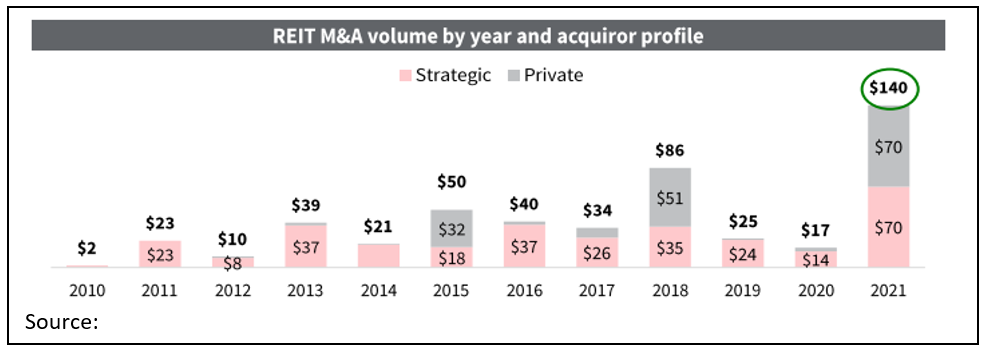

2021 was a record year for listed real estate M&A with $140bn[8] of activity alone in the US REIT market (see below). This was driven by strong pent-up demand and attractive valuations following the pandemic, with many deals agreed at significant premiums. As in other sectors, real estate is also benefiting from the popularity of telecommunications and technology assets with three of the top-five largest deals last year involving REITs with data centre properties.

SKAGEN m2 benefitted from the deal drive with a record number of portfolio take-outs last year and the trend has continued with Paramount Group, a top ten holding, receiving a bid in the first quarter. High demand for property assets, low cost of capital and plentiful acquirers with significant dry powder should mean M&A activity remains a prominent theme in 2022.

5. Sustainability

ESG is much more than a hygiene factor when investing in real estate, it is a key differentiator. Demand for properties built and managed in a sustainable way continues to rise and companies able to meet it can command premium prices and rents.

In real estate, perhaps more than any other asset class, there is a direct link between sustainability and profitability. Research[9] last year of over 2,700 London office buildings found that those rated ‘Very Good’, ‘Excellent’ or ‘Outstanding’ on green metrics have enjoyed rental premiums of between 3.7% and 12.3% over the past decade.

This has been a longstanding investment theme for SKAGEN m2 as we see ESG as a key driver of reducing risk as well as boosting returns. Many of our portfolio companies have science-based emissions targets and several have been recognised as being best-in-class for sustainability. You can read about some of them in our latest ESG report.

Summary

In conclusion, there has perhaps never been a better time to invest in listed real estate. Valuations are compelling and rising inflation means that assets will attract investors as well as strategic buyers, providing further momentum.

The outlook for SKAGEN m2 is equally positive. The fund is diversified geographically, across segments and well-positioned for most economic scenarios. More importantly, we continue to focus on resilient, cash generative companies with strong balance sheets that we believe will outperform over the long-term.

All figures as at 31/03/2021 unless stated

References:

Intro: Source: MSCI. MSCI ACWI Real Estate IMI vs. MSCI ACWI as at 31/03/2022

[1] Source: ECB. Harmonised Consumer Price Index (annual % change), March 2022

[2] Source: NAREIT, 15/05/2021

[3] Source: SKAGEN / Bloomberg for VINX Real Estate Index (in NOK), NAREIT for Middle East and Africa (in EUR)

[4] Source: SKAGEN as at 28/02/2022, Large-cap: Over $10 Billion, mid-cap: $2 billion - $10 billion, small-cap: Below $2 billion

[5] Source: UBS, Global Real Estate Key Valuation Metrics, 31/03/2022

[6] Source: CoStar, NAREIT

[7] Source: IMF World Economic Outlook, January 2022

[8] Source: JLL, M&A and Strategic Transactions Monitor, March 2022

[9] Source: Knight Frank, The Sustainability Series, 2021